Press Releases

CCA Looks for Increasing Investment Opportunities in US Infrastructures

May 19, 2014

China Construction America (CCA) President Ning Yuan attended the Ambassador’s Investment Forum on US infrastructure at invitation, which was hosted by Mr. Max Baucus, US Ambassador to China, at the US Embassy in Beijing, China.

As a key leader in the burgeoning field of China’s outbound investment to the US, Mr. Yuan was invited to speak at the Elements for Successful Infrastructure Investment panel and attended a private lunch hosted by Ambassador Baucus.

“The forum provided us a great platform for an open dialogue on infrastructure investment opportunities between Chinese investors and relevant parties from the US.” said Mr. Yuan, “CCA is keen to invest in US infrastructure through Public-Private-Partnership (PPP). We have been operating in the US for almost 30 years, and have completed a number of significant infrastructure projects in the country. We are well equipped with the technical expertise and financial capabilities to perform any PPP transportation infrastructure project in the US.”

According to a US Chamber of Commerce report, more than $8 trillion in new investment will be needed in US transportation, energy, water and wastewater infrastructures from 2013 through 2030, totaling some $455 billion per year. “Introducing Chinese investment into the US infrastructure market would be a win-win partnership for both countries, and PPP is so far proven to be the best way to materialize such partnership.” said Mr. Yuan.

Mr. Yuan said, “PPP entails speedy delivery of projects. It transfers scheduling and cost overrun risks to private sectors to the benefit of the US taxpayers and public authorities. More importantly, PPP can take advantage of private sector know-how and innovation to improve cost efficiency and effectiveness throughout the project life cycle.”

CCA is the wholly-owned subsidiary of the Beijing-based China State Construction Engineering Corporation (CSCEC), one of the largest global construction conglomerates and a Fortune Global 500 company listed in Shanghai Stock Exchange.

Founded in 1985, CCA has approximately 3500 employees in the US and the Caribbean; 98% of its employees in the US are local hires. Headquartered in Jersey City, New Jersey, CCA mainly operates in the New York tri-state area, Washington DC, South Carolina, Florida, California andThe Bahamas. Serving both public and private clients, it offers a wide array of services including general contracting, construction management, project management, design-build, project financing and real estate development.

In 2014, CCA successfully acquired Plaza Construction (Plaza), a US construction company incorporated in 1986 and headquartered in Manhattan, New York. The acquisition strengthens CCA’s building division and results in a consolidated revenue of approximately $1.8 billion, making CCA a top 50 contractor in the US.

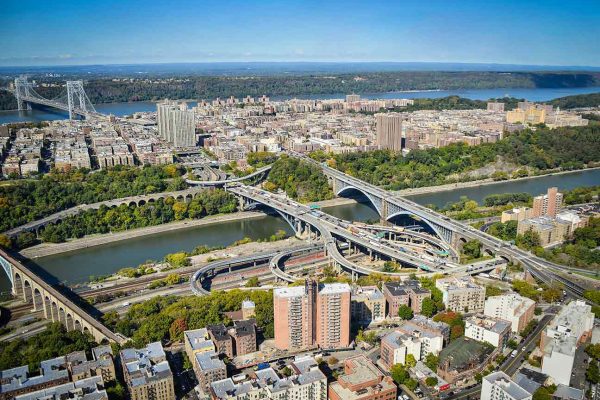

Since its establishment, CCA has been committed to the pursuit of excellence, which is underpinned by its practical business approaches as well as ambitious yet prudent development strategies. In 2013, CCA purchased 99 Hudson, a mixed-use development site in Jersey City, New Jersey, and 445 South Street, Morristown, a premier Class A office building in New Jersey, bringing its real estate business to the next level. CCA also won two construction contacts, with a combined contract value of approximately $335m, in the Pulaski Skyway project, a critical connection between and New York City and New Jersey. By the end of 2014, CCA’s $2 billion Baha Mar project, the biggest single-phase development project in the Caribbean with a total investment of $3.6 billion, is due to complete. As the sole financial advisor who facilitated the project into fruition, CCA aspires to replicate the business model in the US market.

Press contact: Sharon Zhang

Tel: 201-876-2788 x130

Email: Zhang_xijing@chinaconstruction.us

OTHER Press Releases

- CCA Construction, Inc. Takes Strategic Actions to Address Wrongful New York State Court Decision and Protect Interests of all Stakeholders December 22, 2024

- Greenwich West, Hudson Square’s High Design Tower with a French Twist, Opens to Residents October 21, 2020

- River Club At Hudson Park Hosts Ribbon-Cutting Ceremony With Yonkers Mayor May 15, 2019

- New Downtown Condominium Tower Greenwich West Tops Out On Manhattan’s Reinvented West Side Waterfront January 8, 2019